(307) 201-9911 | admin@bizreshub.pro

The Business Triangle Blog:

From Seed to Success:

Building Your Business Credit, Operational Growth, and Marketing Mastery

It Takes More Than a Seed to Grow a Business – Let’s Build the Forest Together!

Cultivating Successful Business Growth:

Requires careful nurturing, strategic planning, and consistent effort.

Introduction

Starting a business is like planting a seed. The seed represents your idea or skill, but nurturing it into a thriving plant—or even a forest—requires more than good intentions. It takes strategic care, the right tools, and consistent effort.

Many entrepreneurs excel in their trade or profession but often lack the know-how in critical areas like building business credit, optimizing operations, and crafting effective marketing plans.

They’re eager to grow and willing to learn, but they need direction and practical resources to succeed.

This blog will guide you through the three essential components of business success:

EIN-based Business Credit: Establish a strong financial foundation.

Operational Growth: Streamline operations and scale effectively.

Marketing Mastery: Balance strategies and tactics for sustainable growth.

We’ll also touch on compliance—the unseen foundation ensuring your business stays standing

Ready to take control and grow your business with a hands-on approach?

Let’s dig in!

1. Business Credit Built on Your EIN

The Power of EIN Credit

Separating your personal and business finances is the first step toward true business fundability. By establishing credit tied to your EIN, you can access higher credit limits and reduce personal liability.

Key Steps to Building Business Credit:

Foundation First:

Create a professional business presence with a proper address, phone number, and domain.

Vendor Relationships:

Build accounts with vendors who report to business credit bureaus.

Credit Evolution:

Progress to business credit cards and loans as your profile strengthens.

The Reality of Business Credit Challenges

Entrepreneurs often face the struggle of relying on personal credit to fund their business, exposing personal assets to unnecessary risk.

Your Next Step:

Business Growth

With the right education and resources, you can fast-track the journey to EIN credit, creating a foundation for long-term financial independence.

2. Operational Growth: Operational Efficiencies and Scaling

Why Operational Efficiency Matters

As your business grows, inefficiencies can drain time, money, and resources. Streamlining your processes ensures a smoother path to scalability and success.

Tips for Efficiency:

Automate repetitive tasks to free up time.

Optimize workflows for fewer bottlenecks.

Delegate effectively to focus on growth-oriented tasks.

Scaling Successfully:

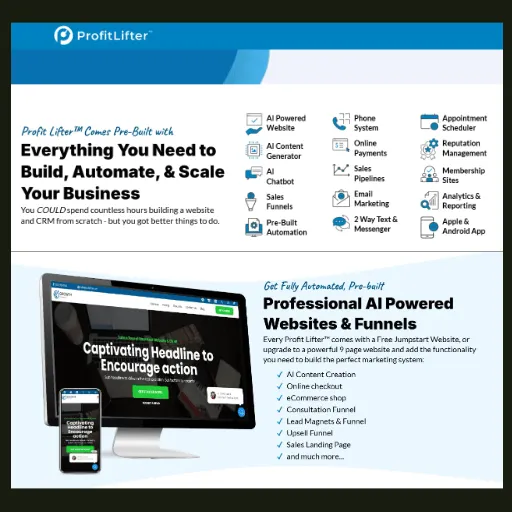

Automation Via CRM and Virtual Assistants Plus

Scaling involves preparing your infrastructure, team, and processes to handle growth without sacrificing quality.

The Reality of Operational Challenges

Without a focus on efficiency and scalability, many businesses plateau, leading to burnout or missed opportunities.

Your Next Step:

System Development

Develop systems that enhance productivity, enabling you to expand confidently and sustainably.

3. Marketing Strategies and Tactics: The Perfect Partnership

Marketing bridges your business to your audience, but confusion between strategy and tactics can lead to wasted efforts. Understanding their roles ensures a balanced, impactful approach.

Marketing Strategy vs. Tactics:

Marketing Strategy

Long-term vision and goals.

Focus on positioning, audience, and value proposition.

Example: Establishing your brand as a premium choice.

Marketing Tactics

Short-term, actionable steps.

Includes campaigns, promotions, and specific actions.

Example: Running a holiday discount campaign on social media.

Why Both Are Essential:

Strategies provide a clear roadmap aligned with business goals.

Tactics execute the strategy, delivering measurable short-term outcomes.

Many businesses focus too much on tactics without a guiding strategy, leading to disjointed efforts and limited results.

The Reality of Marketing Confusion

Strategies and Tactics Go Together

Many businesses focus too much on tactics without a guiding strategy, leading to disjointed efforts and limited results.

Master the art of pairing strategic plans with actionable tactics to build a marketing engine that drives consistent growth.

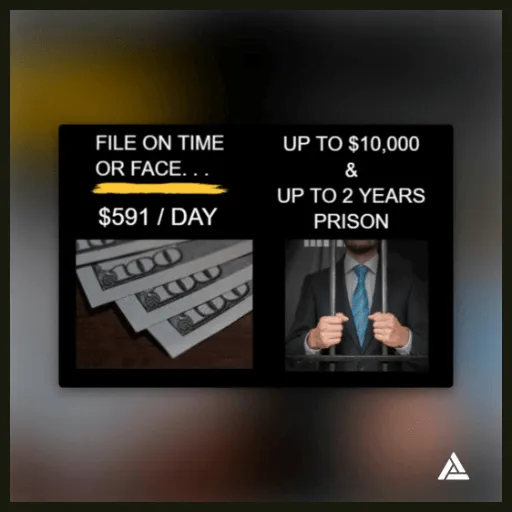

4. Compliance: The Root System of Your Business

Compliance is the invisible foundation supporting your business. From taxes to regulations, staying compliant protects your business from disruptions.

Why Compliance is Non-Negotiable:

Shields your business from fines and penalties.

Builds trust with partners, clients, and institutions.

Establishes credibility and legitimacy.

The Reality of Compliance Oversights

Compliance Do Not Overlook

Overlooking compliance can lead to costly mistakes, from business interruptions to legal issues.

Your Next Step:

Stay proactive with tools and guidance to ensure your business thrives within the rules.

Key Topics We Cover:

Credit Foundation

Business Credit Strategies

Fundability for Growth

Building Credit Fast

Obtaining High Credit Limits

Operational Growth

Operational Efficiencies

Scaling Your Business

Business Organization Tips

Automation Systems

Marketing Mastery

Strategies vs. Tactics

Avatar Creation for Targeted Audiences

Content Creation Tips

Marketing Campaigns

Compliance and Resources

Compliance Issues

Regulatory Updates and New Laws

Tools for Legal and Accounting Requirements

Interactive Features

Free Weekly Tips and Strategy Sessions:

Join us for actionable classes that dive deeper into building credit, optimizing operations, and marketing mastery.

Your Voice Matters:

Conclusion: Plant Your Forest

Build Your Business Into a Forrest With Strength and Stablity

It takes more than a seed to grow a business. By focusing on building EIN-based credit, enhancing operational efficiency, and balancing marketing strategies with tactics, you can grow not just a business but a thriving ecosystem.

Stay grounded with compliance, and let us guide you every step of the way. Together, we’ll nurture your seed into a flourishing forest of success. 🌳

Are you ready to build a fundable, scalable business while staying budget-conscious?

Here, every blog post is tailored to help you grow your business credit, optimize operations, and master marketing—all with tools and tips that deliver maximum impact.

Our content is organized into key sections to guide your journey:

Credit Foundation (CF):

Everything you need to build business credit, fundability tips, loans, and strategies for creating financial stability.

Operational Growth (OG):

Proven tactics for scaling your business, automating workflows, and optimizing cash flow.

Marketing Mastery (MM):

Creative strategies for boosting visibility, generating traffic, and converting leads into loyal customers.

Compliance and Resources (CaR):

Stay ahead with insights on legal updates, essential tools, and compliance must-haves.

Free Weekly Training (FwkSS):

Get step-by-step guidance on business credit, marketing, operations, and more.

Quizzes & Leaderboards (QaLB): Test your knowledge, earn recognition, and make learning fun with interactive challenges.

Now that you have an overview of the sections, here’s a sneak peek at the categories we’ll cover:

Blog Categories by Section

1. Credit Foundation (CF)

This section dives into building and managing business credit off your EIN, a vital step for fundable businesses. Learn strategies for avoiding risks, accessing funding, understanding credit tiers, and leveraging EIN-based credit. These insights ensure you're financially prepared for long-term growth.

1.1 Building Business Credit from EIN:

Learn the step-by-step process of creating business credit separate from personal credit, starting with your EIN. Build credibility, secure better terms, and open new financial doors.

1.1a EIN Credit Purposes and Benefits:

EIN credit builds independence from your SSN. Enjoy lower interest rates, more favorable terms, and increased funding options to scale your business.

1.1b EIN Credit Starts with the IRS Site:

Set up your EIN the right way, directly through the IRS. Starting your credit journey here ensures compliance and separates your business from personal liabilities.

1.2 High-Risk Business Names to Avoid for Funding:

Discover how your business name can impact fundability and learn to avoid pitfalls that could label your business as high-risk to lenders.

1.3 Loans for Startups:

Explore startup-friendly loan options and understand how to secure funding with minimal business history.

1.4 Bad Credit Business Loans:

Discover lenders and strategies to access business loans even with poor credit and how to rebuild for better terms.

1.5 Business Funding Sources:

Navigate reliable funding sources—from banks to alternative lenders—and find the right fit for your needs.

1.6 Fast Business Loans:

Find quick, accessible funding options to address urgent financial needs without compromising long-term goals.

1.7 Fundability Tips and Tools:

Build a fundable business with tips and tools to align with lender requirements and secure approvals.

1.8 Credit Tier Progression:

Understand the credit tier system, learn how to advance, and access higher credit limits and better terms.

1.9 Business Credit Strategies:

Gain expertise in strategic credit management, growth plans, and contingency preparation with proven methods.

1.10 Business Credit Tradelines and Lending:

Learn the differences between tradelines and lending, and how to leverage both for maximum growth.

2. Operational Growth (OG)

Operational success is the backbone of every thriving business. This section covers infrastructure planning, CRM, automation, and revenue operations, ensuring smooth back-end processes that drive efficiency, scalability, and cash flow.

2.1 CRM and Automation:

Streamline your customer relationships and improve workflows using the latest CRM tools and automation technologies.

2.2 Scaling with VA’s and AI:

Learn how to scale your operations efficiently with virtual assistants and AI-powered tools, saving time and reducing costs.

2.3 Infrastructure Planning:

Build a robust infrastructure to support long-term growth, from systems integration to operational scalability.

2.4 RevOps Strategy:

Place revenue operations at the core of your business. Learn how to align marketing, sales, and customer service to maximize efficiency and drive revenue. This is the ideal option for the small business owner of 1-20 employees.

2.5 Cashflow Enhancement - Affiliate Marketing for Cashflow:

Unlock new income streams with affiliate marketing strategies tailored to boost cash flow for small businesses and entrepreneurs.

3. Marketing Mastery (MM)

Marketing fuels business visibility, engagement, and growth. This section offers expert insights on content creation, marketing tactics, traffic generation, and more, helping you connect with your audience and achieve measurable success.

3.1 Content Creation:

Craft impactful content that resonates with your audience, drives traffic, and grows your brand through storytelling and strategic messaging.

3.2 Avatar Creation Using ChatGPT:

Use AI to create detailed customer avatars, allowing for highly personalized and targeted marketing campaigns.

3.3 Marketing Strategies and Tactics:

Unlock strategies to increase visibility, reach your audience effectively, and stay competitive in your niche.

3.4 Email Marketing:

Create campaigns that engage subscribers, boost conversions, and build loyalty through effective email strategies.

3.5 Ads:

Master paid advertising with targeted campaigns, compelling creatives, and ROI-focused optimization techniques.

3.6 Traffic:

Drive high-quality traffic to your website with proven SEO and digital marketing strategies that convert visitors into customers.

3.7 Website Tips and Development:

Optimize your website for performance, design, and user experience to build trust and generate leads.

3.8 Reviews and Their Importance for Growth:

Harness the power of customer reviews to build credibility, attract new clients, and improve service delivery.

3.9 Marketing Operations - Engagement and Recognition:

Align marketing and operations to enhance customer engagement, foster loyalty, and drive business growth.

3.10 Business Growth Strategies and Tactics:

Learn actionable strategies to expand your business sustainably and boost revenue.

3.11 Website Development and Optimization:

Create websites that deliver results with expert insights into speed, usability, and content optimization.

3.12 App Development for Customer Engagement:

Explore innovative apps that enhance customer interaction, simplify communication, and foster loyalty.

4. Compliance and Resources (CaR)

This section simplifies complex legal and compliance requirements while providing tools and resources to save money and stay on track. Understanding and applying these insights protects your business from costly penalties.

4.1 New Laws & Regulation Updates:

Stay informed on legal updates that impact your business, and learn how to stay compliant with evolving regulations.

4.2 Legal and Compliance Essentials:

Navigate compliance basics to avoid penalties and maintain a solid operational foundation.

4.3 Beneficial Ownership Reporting:

File BOI reports with confidence using step-by-step guidance to meet requirements and avoid consequences.

4.4 Tools for Business Credit Building:

Discover software and tools designed to simplify building and maintaining a strong business credit profile.

4.5 Other Services That Save You Money:

Explore services like LegalShield that protect your business and help you avoid costly legal issues.

4.6 Productivity Tools for Entrepreneurs:

Maximize efficiency with tools that streamline workflows, save time, and improve overall results.

5. Free Weekly Tips and Strategy Sessions (FwkSS)

Weekly tips and strategies bring you actionable insights on credit building, marketing, and compliance. Join training sessions and access tailored guidance to sharpen your skills and stay ahead of the curve.

5.1 Free Weekly Training on Assorted Topics:

Attend expert-led weekly training sessions covering business credit, operations, marketing, and more.

5.2 Academy Training Membership Site:

Get exclusive access to in-depth courses that break down business fundamentals and advanced strategies.

5.3 Triangle Topics: Business Credit, Marketing, Operations, Compliance:

Learn how these interconnected areas build a stable and fundable business foundation.

6. Quizzes and Leaderboards (QaLB)

Engage with fun and challenging quizzes on business topics to test your knowledge, track your progress, and earn rewards. Leaderboards create recognition and friendly competition while encouraging growth.

6.1 Quizzes and Leaderboards:

Take interactive quizzes, earn badges, and climb leaderboards while enhancing your understanding of business concepts.

You’ll notice each blog begins with the section abbreviation (e.g., CF, OG, MM) to help you quickly identify its focus. Understanding how these sections interconnect gives you actionable insights to grow a sustainable and fundable business. If you have a topic that you do not see be sure to request it at the bottom of the page.

Dive in, explore, and let’s unlock your business potential!

Credit Foundation

Operational Growth

Marketing Mastery

Building a Fundable Business: Essential Steps in Business Credit 101

Building a Fundable Business: Essential Steps in Business Credit 101

Does Jackson’s Struggle Sound Familiar

Meet Jackson, a dedicated small business owner juggling the complexities of managing finances, growing his business, and staying compliant with regulations. Like many entrepreneurs, Jackson often finds himself in a paycheck-to-paycheck cycle, relying on personal credit to fund his business operations. He feels stuck—his marketing efforts yield inconsistent results, operational inefficiencies slow his progress, and the fear of compliance missteps looms large.

But what if Jackson could separate his personal and business finances, establish a secure credit line, and unlock a clear path to sustainable growth? That’s where business credit comes in.

In our Business Credit 101 session, we’ll walk through the steps Jackson—and entrepreneurs like him—can take to build a strong business credit foundation, making their business more fundable and resilient.

Why Business Credit Matters for Entrepreneurs Like Jackson

Entrepreneurs often rely on personal credit to fund their businesses, tying their financial health to their company’s performance. For Jackson, this means sleepless nights worrying about maxed-out credit cards and the inability to scale his business.

Business credit offers a solution:

Separating Personal and Business Finances: By using an EIN instead of his SSN, Jackson can protect his personal credit while building a credit profile for his business.

Increased Borrowing Power: Business credit effectively doubles Jackson’s borrowing capacity, allowing him to fund operations and growth without depleting personal savings.

Peace of Mind: No personal guarantees mean Jackson’s personal credit score isn’t at risk, giving him greater confidence in his financial decisions.

With strong business credit, Jackson can unlock opportunities like better financing terms, larger credit limits, and improved cash flow—critical tools for breaking free from his financial stress.

Steps to Build Fundable Business Credit

Set Up a Credible Business Foundation

Jackson learns that fundability starts with a credible business structure. Here’s how he ensures his business is set up properly:Register an Entity: Jackson transitions from a sole proprietorship to an LLC, giving his business a professional identity separate from his personal finances.

Get an EIN: He secures his Employer Identification Number (EIN) through IRS.gov, avoiding third-party fees.

Establish a Professional Presence: Jackson upgrades to a virtual business address with iPostal1, sets up a business phone number, and creates a professional email (e.g., admin@jacksonsauto.com).

Impact for Jackson: By making these changes, Jackson gains credibility with lenders and ensures his business listings are consistent across directories, reducing his fear of missed funding opportunities due to inconsistencies.

Open a Business Bank Account

Jackson opens a dedicated business bank account with Relay Financial, separating his personal and business finances. He sets up multiple accounts for operations, taxes, and savings, ensuring better cash flow management.

Why It Matters: This step not only builds fundability but also helps Jackson stay compliant with tax and legal requirements, easing his regulatory fears.Build Credit with Vendor Accounts

Jackson starts with vendor credit accounts that report to business credit bureaus. He uses net-30 terms from suppliers like Uline and Quill, purchasing essentials for his business and paying off balances early.

Pro Tip: Jackson leaves the SSN field blank on credit applications to avoid linking these accounts to his personal credit.Monitor and Maintain Credit Scores

Jackson signs up for business credit monitoring services to track his progress and identify areas for improvement. He learns that business credit scores are based on payment history alone—making early, consistent payments his top priority.

The Benefits of Strong Business Credit

As Jackson follows these steps, he starts to see significant changes:

Improved Financial Flexibility: With vendor and revolving credit lines in place, Jackson can invest in marketing, hire staff, and purchase equipment without worrying about cash flow.

Growth Opportunities: Access to funding allows Jackson to expand his operations, meet rising demand, and finally scale his business.

Reduced Stress: Knowing his business is fundable and compliant gives Jackson peace of mind to focus on what he does best—serving his customers.

For Jackson, building business credit transforms his financial outlook, providing the tools he needs to thrive in a competitive market.

Take the First Step Toward Fundability

Jackson’s story illustrates the power of a strong business credit foundation. Whether you’re a startup owner or an experienced entrepreneur, building business credit can unlock opportunities, reduce stress, and set the stage for sustainable growth.

Join us for Business Credit 101 and learn how to make your business more fundable. From setting up a credible foundation to leveraging credit for growth, we’ll guide you every step of the way. Let’s take the first step toward transforming your business—and your peace of mind—today!

Building a Fundable Business: Essential Steps in Business Credit 101

Building a Fundable Business: Essential Steps in Business Credit 101

Does Jackson’s Struggle Sound Familiar

Meet Jackson, a dedicated small business owner juggling the complexities of managing finances, growing his business, and staying compliant with regulations. Like many entrepreneurs, Jackson often finds himself in a paycheck-to-paycheck cycle, relying on personal credit to fund his business operations. He feels stuck—his marketing efforts yield inconsistent results, operational inefficiencies slow his progress, and the fear of compliance missteps looms large.

But what if Jackson could separate his personal and business finances, establish a secure credit line, and unlock a clear path to sustainable growth? That’s where business credit comes in.

In our Business Credit 101 session, we’ll walk through the steps Jackson—and entrepreneurs like him—can take to build a strong business credit foundation, making their business more fundable and resilient.

Why Business Credit Matters for Entrepreneurs Like Jackson

Entrepreneurs often rely on personal credit to fund their businesses, tying their financial health to their company’s performance. For Jackson, this means sleepless nights worrying about maxed-out credit cards and the inability to scale his business.

Business credit offers a solution:

Separating Personal and Business Finances: By using an EIN instead of his SSN, Jackson can protect his personal credit while building a credit profile for his business.

Increased Borrowing Power: Business credit effectively doubles Jackson’s borrowing capacity, allowing him to fund operations and growth without depleting personal savings.

Peace of Mind: No personal guarantees mean Jackson’s personal credit score isn’t at risk, giving him greater confidence in his financial decisions.

With strong business credit, Jackson can unlock opportunities like better financing terms, larger credit limits, and improved cash flow—critical tools for breaking free from his financial stress.

Steps to Build Fundable Business Credit

Set Up a Credible Business Foundation

Jackson learns that fundability starts with a credible business structure. Here’s how he ensures his business is set up properly:Register an Entity: Jackson transitions from a sole proprietorship to an LLC, giving his business a professional identity separate from his personal finances.

Get an EIN: He secures his Employer Identification Number (EIN) through IRS.gov, avoiding third-party fees.

Establish a Professional Presence: Jackson upgrades to a virtual business address with iPostal1, sets up a business phone number, and creates a professional email (e.g., admin@jacksonsauto.com).

Impact for Jackson: By making these changes, Jackson gains credibility with lenders and ensures his business listings are consistent across directories, reducing his fear of missed funding opportunities due to inconsistencies.

Open a Business Bank Account

Jackson opens a dedicated business bank account with Relay Financial, separating his personal and business finances. He sets up multiple accounts for operations, taxes, and savings, ensuring better cash flow management.

Why It Matters: This step not only builds fundability but also helps Jackson stay compliant with tax and legal requirements, easing his regulatory fears.Build Credit with Vendor Accounts

Jackson starts with vendor credit accounts that report to business credit bureaus. He uses net-30 terms from suppliers like Uline and Quill, purchasing essentials for his business and paying off balances early.

Pro Tip: Jackson leaves the SSN field blank on credit applications to avoid linking these accounts to his personal credit.Monitor and Maintain Credit Scores

Jackson signs up for business credit monitoring services to track his progress and identify areas for improvement. He learns that business credit scores are based on payment history alone—making early, consistent payments his top priority.

The Benefits of Strong Business Credit

As Jackson follows these steps, he starts to see significant changes:

Improved Financial Flexibility: With vendor and revolving credit lines in place, Jackson can invest in marketing, hire staff, and purchase equipment without worrying about cash flow.

Growth Opportunities: Access to funding allows Jackson to expand his operations, meet rising demand, and finally scale his business.

Reduced Stress: Knowing his business is fundable and compliant gives Jackson peace of mind to focus on what he does best—serving his customers.

For Jackson, building business credit transforms his financial outlook, providing the tools he needs to thrive in a competitive market.

Take the First Step Toward Fundability

Jackson’s story illustrates the power of a strong business credit foundation. Whether you’re a startup owner or an experienced entrepreneur, building business credit can unlock opportunities, reduce stress, and set the stage for sustainable growth.

Join us for Business Credit 101 and learn how to make your business more fundable. From setting up a credible foundation to leveraging credit for growth, we’ll guide you every step of the way. Let’s take the first step toward transforming your business—and your peace of mind—today!

Compliance and Resources

Free Weekly Tips and Strategy Sessions

Quizzes and Leader Boards

Unlock Business Success:

Build EIN Credit

with

Suzette Helaine Kooyman

With an MBA in Marketing and deep experience in both for-profit and nonprofit business structures, I understand the struggles and triumphs of business ownership firsthand.

I've walked in your shoes, tackling challenges with a tenacious, DIY mindset to streamline costs, boost efficiency, and drive profitability. My expertise goes beyond business credit development and funding—I also share innovative marketing and business strategies tailored to help you grow.

To support our business community, I offer free weekly training on a variety of topics and am building an Academy membership site for more personalized guidance.

Whether you're launching a startup or growing an established business, I’ll provide actionable insights to transform your credit profile and strengthen your operations.

Let’s tackle your goals together

Schedule your session today!

Revamp Your Funding Strategy and Fuel Growth

Unlock our software to secure credit and boost your marketing.