BUILDING BUSINESS CREDIT

IS NOT THE SAME

AS BUILDING PERSONAL CREDIT

Covering some of the basics here will allow us

more time to answer specfic questions for your business in our cousultation.

YOUR SUCESS IS OUR PASSION!

What is Business Credit?

We’ve found that when people are first starting their business credit journey, they often don’t fully understand some of the key aspects of building business credit and how it can impact their personal credit, liabilities, and other areas of their business. Building business credit is not just about getting loans—it’s about laying a strong foundation for long-term business success. To help you get started, we’ve highlighted nine key areas you need to understand. As you explore further, you’ll likely have more questions—and we’ve got the answers ready for you.

While you’ll find FAQs sprinkled throughout the site, each section is designed to address specific topics in detail. We recommend reading through them all, but we know time is valuable. That’s why we’ve provided quick snapshots of the top nine—just click on any topic above to jump straight to the answers you're most curious about. Ready to dive deeper into the world of business credit, funding, and scaling? Schedule your strategy call with us today to get personalized insights for your business!

**Who Is Bizreshub LLC and What Do They Do?

**What Are The Business Credit Basics

**Financial Security & Risk Management

**Building Business Credit:

Process And Timeline

**Benefits Of Business Credit

**Business Credit Monitoring And Vendors

**Personal Credit & Business Credit

**Enhancing Business Credit

**Business Lending Vs. Business Credit:

Understanding The Difference And Why You Need Both

Who Is BizResHub LLC and What Do They Do?

At BizResHub LLC, we’re more than just a service—we’re your dedicated partner in building lasting business credit, starting with your EIN. Think of us as the guide on your journey to financial independence. We follow a proven step-by-step process to help you get your business credit in place within 12 months or less. But we don’t stop there. We take a holistic approach to business growth, addressing key components such as business credit, operations, marketing, and lending strategies to help your business thrive.

Our goal is to meet you where you’re at and work together to define and achieve your growth goals. Whether it’s fine-tuning your operations for efficiency, creating marketing strategies to boost revenue, or securing the best loan terms and rates, we offer resources, consulting, and tools tailored to your unique needs.

What makes BizResHub LLC stand out?

Unlike many other credit services, we don’t just focus on one aspect of your business. We consider the bigger picture. BizResHub LLC focuses on business development, cash flow, and lending alongside credit, ensuring you have the complete support system you need to scale successfully. We help with compliance, legal matters, marketing strategies, and more, all while focusing on the specific needs of your business.

Ready to get started? Reach out to us today and let’s discuss how BizResHub LLC can help you achieve your financial and business goals.

Business Credit Basics

Building business credit can feel overwhelming, but we’re here to make it simple. Let's break down the essentials so you can confidently start building your business credit.

Do I need good personal credit to start?

Nope! One of the best parts about our approach is that we focus on establishing business credit using your EIN. This way, your personal credit score doesn’t hold you back. You can focus on building your business credit while still improving your personal credit.What’s the difference between personal and business credit?

Great question! Personal credit reflects your individual financial history, like how you’ve managed personal loans and credit cards. Business credit, on the other hand, is about your company’s financial health. It’s based on how well your business manages debt, pays bills on time, and handles financial obligations. While personal credit can enhance your business credit, they remain separate, and that’s key to protecting your assets.Why is it important to build business credit separately from personal credit?

Keeping business credit separate from personal credit reduces risk. It helps protect your personal finances from business debt, and it keeps you safe from “piercing the corporate veil”—where you could be personally liable for business issues.Can startups benefit from your services?

Absolutely! We love working with startups, helping them build a solid financial foundation from the beginning. Whether you’re just starting or have been in business for a while, we provide guidance that’s flexible enough for businesses at every stage.

Is BizResHub LLC’s process difficult to follow?

Not at all! We aim to make the process as simple and straightforward as possible. With clear steps and expert consultants, you’ll find the journey stress-free.

Ready to get started on the right path? Schedule a free consultation with us today!

Financial Security & Risk Management

Starting your business credit journey isn’t just about securing funding—it’s about ensuring your long-term financial stability. Here’s how BizResHub LLC can help minimize your risks and set your business up for success.

How can I establish business credit as a new business owner?

If you're new to business ownership, the first steps are straightforward but crucial: Register your business, get your EIN, open a business bank account, and apply for vendors and business credit cards. While this may seem simple, things can get complicated if done in the wrong order or with the wrong vendors. A simple mistake in the process could cost you time, effort, and even result in denials before you get started. Even your company name, website, and NAIC code matter. Book an appointment to go over the details—it might surprise you what’s blocking your funding.How does building business credit provide financial security?

When you build business credit, you unlock access to loans, better terms with vendors, and a financial cushion in times of hardship or expansion. Plus, it’s an entirely separate credit profile, which protects your personal finances. As a business owner, you can access 10-100 times more in business credit than personal credit, even if you have great personal credit.

Another reason to build business credit using your EIN instead of your SSN.

Many business owners, particularly parents, find themselves cosigning loans of all types—signature loans, auto loans, and especially student loans. In fact, did you know that approximately 90% of private undergraduate student loans require a cosigner? Due to their children's limited credit history, many parents feel compelled to cosign these loans. While you may want to help your child, cosigning loans adds personal liabilities that can impact your ability to secure business funding.

However, there’s an often-overlooked risk with federal student loans. If your child defaults or misses a payment, your credit is at risk. Even a missed payment, unintentionally, can hurt your credit score. Federal student loans offer protections like forbearance or income-driven repayment for the borrower, but cosigners don’t always have these options. This situation can further affect your ability to secure business funding, especially if you’re the primary income earner for your family.

At BizResHub LLC, we can help you protect your personal credit while navigating these financial challenges, so you can continue to build your business and support your family.

Ready to build a solid financial foundation? Schedule a strategy call with us to understand how BizResHub LLC can help secure your financial future.

Building Business Credit: Process and Timeline

Building business credit is a journey, and it doesn’t happen overnight. But with the right guidance and approach, you’ll be on track in no time. Here’s what to expect along the way:

How long does it take to build business credit?

Building business credit can take anywhere from 6 months to a few years, depending on your business’s financial habits, payment history, and how consistently you open business credit accounts. While the process may feel slow at times, you’ll start to see significant progress in less than a year if you follow the right steps.

How long does it take for vendors to start reporting business credit?

Most vendors begin reporting your business credit within 45 to 90 days. However, this timeline can vary depending on their reporting schedules. It’s essential to stay proactive and monitor your credit progress to ensure you’re on track.

Do all vendors report business credit?

Here’s a critical point that often gets overlooked—only about 10% of vendors actually report business credit. Many businesses mistakenly believe they’ve built up a solid credit history with their vendors, only to discover that none of their payments were reported to the credit bureaus. Why does this happen? Reporting positive business credit can be expensive for vendors, and not all meet the criteria to report consistently. However, it doesn't cost them anything to report late or no payments.

That’s where BizResHub LLC comes in. We know exactly which vendors are reliable for reporting business credit, and we make sure that the vendors we recommend follow through. Plus, we monitor their reporting status on a monthly basis, so you don’t have to guess. If you’re working with vendors who don’t report, we’ll show you ways to get your payments to show up on your credit report through other channels.

Is there ongoing support after building business credit?

Absolutely! Our support doesn’t stop once you’ve built your business credit. At BizResHub LLC, we’re committed to your long-term success. We provide ongoing guidance and advice as your business continues to grow and scale. Whether it’s refining your strategy, exploring new lending options, or just making sure you’re on track, we’re here to help every step of the way.

Benefits Of Business Credit

Building business credit isn’t just about borrowing money—it’s about unlocking a range of opportunities that can accelerate your growth and secure your financial future. A strong business credit profile gives you access to resources and funding when you need it, without impacting your personal credit. Let’s take a closer look at how having strong business credit benefits your company in ways you might not expect.

What are the benefits of building business credit?

The benefits of building business credit are powerful and can help you move your business forward. A solid business credit profile allows you to:

Secure loans and credit lines

Get better vendor terms

Increase financial security

Open doors to new growth opportunities

And here’s the kicker: while personal credit reports are generally static, business credit reports can be pulled at any time. This means potential clients might check your business credit report before deciding whether to work with you. A strong business credit profile reflects how well you handle your finances and can often predict how well you deliver your product or service. A solid business credit report can help you close more sales and win bigger contracts.

Can business credit help me access government contracts?

Absolutely! Government agencies often check your business credit when reviewing eligibility for contracts or grants. A strong business credit profile boosts your company’s credibility and significantly increases your chances of securing those contracts. The more solid your credit, the more trust you’ll gain from potential partners and clients.

Can business credit be used to purchase property or invest in my business?

Yes! Establishing business credit puts you in a position to qualify for larger loans and credit lines. This enables you to purchase property, invest in equipment, or fund your business expansion. Plus, when you purchase property in your business’s name, you can later use it as collateral for more funding, creating an asset that can grow with your business.

What if I already have strong cash flow?

Even with strong cash flow, business credit plays a crucial role in your long-term financial security. It’s key to have your business credit in place while your cash flow is strong and on the rise—don’t wait until you need it. Much like personal credit, it’s easier to get a loan when you don’t need it. And, the amount of funding you can access isn’t just about your current cash flow—it’s also about the growth trajectory of your business. Build your business credit and lending portfolio now, before you need it. Many mortgage brokers with six- or seven-figure cash flow went bankrupt within 48 hours during the 2008 mortgage crisis because they didn’t plan ahead with business credit, assuming cash flow would always be there.

Ready to take the next step?

Building business credit is essential for long-term growth and financial stability. Schedule a free consultation today to get personalized guidance on how to set your business up for success.

Business Credit Monitoring and Vendors

Tracking your business credit and working with the right vendors is crucial for ensuring long-term financial success. At BizResHub LLC, we provide the tools, expertise, and support to help you stay on top of your business credit and accelerate your growth.

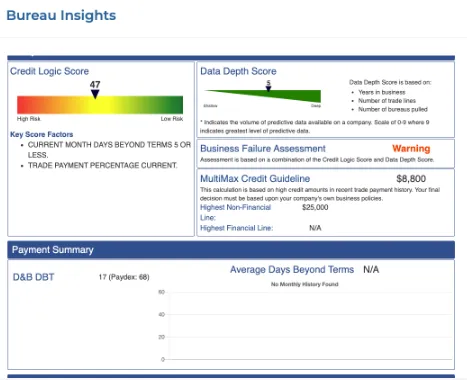

How can I monitor my business credit through BizResHub LLC?

We offer a service called "Bureau Insights"—much more comprehensive and informative than any of the public credit monitoring systems available. With Bureau Insights, you get to see exactly what lenders see when evaluating your business, and most importantly, you’ll uncover the things they won’t tell you. This invaluable service provides you with an in-depth look at your business credit, enabling you to take proactive steps to improve it. You can download Bureau Insights & Scores Every 30 Days!

How many lenders and vendors does BizResHub LLC have access to?

We’ve partnered with over 1,000 lenders and vendors across a broad range of industries, including some of the most specialized ones. Because of the volume of loans we help secure with our lenders, our relationship with them grants you the best rates and terms available to you, ensuring that you get the most favorable conditions for your funding needs.

What resources does BizResHub LLC provide?

At BizResHub LLC, we’re committed to your long-term success. To help your business grow, we offer more than just business credit monitoring. We provide detailed guides, financial tools, and one-on-one consultations to ensure you understand your options. But we don’t stop there—we take it a step further by offering a full analysis of your online presence, operational evaluations, and marketing enhancement resources to help you capture more leads and scale effectively. We can also evaluate some of the vendors that you are currently using for credit, business operations, and marketing to ensure you’re getting the most efficient and cost-effective tools and resources available. We want to grow with you every step of the way, ensuring that your business credit, operations, and marketing efforts are all working together to fuel your success.

Ready to take your business to the next level?

Schedule a Funding Strategy Call with us today to get a personalized roadmap for growing your business and securing the best funding options available.

There are 10 key differences between personal credit and business credit.

1. Control Over Credit Reporting

Personal Credit: Personal credit is regulated by the federal government and requires your consent before anyone can pull your credit report. Lenders and other entities must get your permission before accessing your personal credit file.

Business Credit: On the other hand, business credit can be pulled by anyone, for any reason, without your permission. This means that businesses or vendors can access your credit report for risk assessment or evaluating potential partnerships, without needing to notify you first.

2. Grace Period

Personal Credit: Personal credit accounts typically have a 30-day grace period before a late payment appears on your credit report. If you're just a day or two late, your credit score may not be affected, but you could face a late fee.

Business Credit: No grace period exists for business credit accounts. If you miss a payment, even by a few days, it will immediately show on your business credit report. It’s important to pay close attention to payment terms and due dates to avoid negative impacts.

3. Cash Transactions

Personal Credit: Personal credit reporting allows for flexibility with credit use, and payments made on time directly impact your credit score.

Business Credit: If you pay before the invoice is sent, even if you know the amount, it will be categorized as a cash transaction and will not help build your business credit. To positively impact your business credit, vendors need to report a transaction in which a credit relationship is established.

4. Payment Timeliness and Reporting

Personal Credit: Personal credit providers report to the credit bureaus on a consistent schedule, usually monthly, and as long as you meet your payment deadlines, you won’t see any negative impacts.

Business Credit: For business credit, the timing of payments is crucial. If you pay close to the due date, the payment may not be processed in time for it to reflect on the credit reporting date, which means the vendor’s report won’t show up as a positive payment for your business credit profile. Paying early may result in the transaction not being recorded.

5. Vendor Names and Reporting

Personal Credit: On personal credit, when you use a vendor, such as Home Depot, it will appear as Home Depot on your credit report. This makes it easy to track where your credit is coming from and how it is being used.

Business Credit: Business credit reports don’t list individual vendor names in the same way. For instance, instead of seeing "Home Depot," you may see a category description, like building supplies, reflecting the nature of the business or expense. This can be a benefit in business credit reporting if you use vendors or lenders that report to multiple credit agencies, as it may improve the diversity of your business credit history.

6. Building and Establishing Credit

Personal Credit: Personal credit is generally built around a person’s credit utilization, payment history, and credit inquiries. Building personal credit often takes several years of consistent use, with credit cards and loans contributing to your credit history.

Business Credit: Building business credit is a more dynamic process. It’s tied to your EIN rather than your Social Security Number, and many factors contribute to the process, including your company's operating history, vendor relationships, and timely payments to service providers. It can also grow much faster than personal credit if handled correctly.

7. Credit Inquiries and Impact

Personal Credit: Every time someone checks your personal credit, it is noted as an inquiry on your report. Too many inquiries can hurt your score, as it may imply you're seeking a lot of credit at once.

Business Credit: Business credit inquiries are less impactful on the score compared to personal credit, especially if they are soft inquiries. A business may receive numerous inquiries from potential vendors, lenders, or other business partners without significantly hurting the business’s credit score.

8. Impact of Debt-to-Income Ratio

Personal Credit: A key factor in personal credit is the debt-to-income (DTI) ratio, which impacts your ability to get approved for loans or credit cards. If you have high personal debt relative to your income, it can harm your ability to obtain further credit.

Business Credit: For business credit, DTI isn’t necessarily a primary concern. Lenders are more likely to look at your company’s ability to generate revenue and its financial statements to determine your borrowing potential. High levels of debt or equity investors in a business may have different implications compared to personal credit

9. Liability and Risk

Personal Credit: With personal credit, the individual is personally liable for all the debts associated with their credit accounts. If you fall behind or miss payments, your personal assets can be at risk.

Business Credit: With business credit, the business itself is primarily responsible for the debt, not the business owner personally. However, if you personally guarantee a business loan, your personal assets may be at risk if the business defaults on the loan.

10. Reporting Agencies and Data

Personal Credit: Personal credit reports are managed by three major credit bureaus: Equifax, Experian, and TransUnion.

Business Credit: Business credit is reported by multiple agencies, including Dun & Bradstreet, Equifax, Experian, and others. Each agency may have different data, and it’s crucial for business owners to regularly check all reports to ensure they are accurate and reflective of their financial activities.

Key Takeaways

While personal credit and business credit share some similarities, their differences are crucial for business owners to understand. Business credit is more fluid, allows for greater flexibility, and carries different regulations and impacts on your company’s growth. It’s vital to separate the two and develop business credit with the same care and attention you would apply to personal credit, but with a focus on long-term business growth and financial independence.

If you want to make sure your business is on the right path to securing credit, funding, and a strong financial future, it’s important to start building business credit today.

Schedule a Funding Strategy Call with BizResHub LLC to get personalized guidance and support.

Enhancing Business Credit

Building your business credit is an ongoing process. It’s about consistent, responsible use of credit and being proactive in how you manage your finances.

How can I improve my business credit score?

Start by paying bills on time, reducing debt, and maintaining strong relationships with your vendors. Unlike personal credit, business credit doesn't offer a grace period. In fact, if you pay your bill on the due date, it’s often too late to prevent it from being marked as late. The payment window for business credit can range from 7 to 90 days, depending on the vendor. If you pay too early, it may count as a cash transaction, which won't help your credit. But if the payment doesn’t post in time, it may show up as late.

We can help you navigate this process to maximize your credit score. Book a free consultation to find out the best strategies for improving your business credit score.Is there a minimum credit score to start building business credit?

No minimum score is required. Building business credit is about maintaining solid financial habits—timely payments and responsible credit usage. Your score will improve gradually as you follow the right steps.

Business Lending vs. Business Credit:

Understanding the Difference and Why You Need Both

Business credit and business lending go hand in hand to fuel your growth. Here’s why you need both.

What’s the difference between business lending and business credit?

Business lending involves borrowing money from a financial institution—like a bank or credit union—and agreeing to repay it with interest. Business credit, however, is a reflection of your company’s ability to manage debt and financial obligations. Having both allows you to qualify for better terms and lower interest rates when seeking financing.Do you need both business lending and business credit?

Yes! Having both provides financial flexibility and stability. Strong business credit helps you qualify for loans at favorable terms and interest rates, while business lending allows you to finance growth and operational needs without risking personal assets.